Though it’s not getting huge publicity as Amendments 3 and 4, (marijuana and abortion) Amendment 5 is starting to receive attention from those in favor of it and those opposing.

Amendment 5 deals with Homestead Property Tax exemptions, which is nothing new to voters living in Florida.

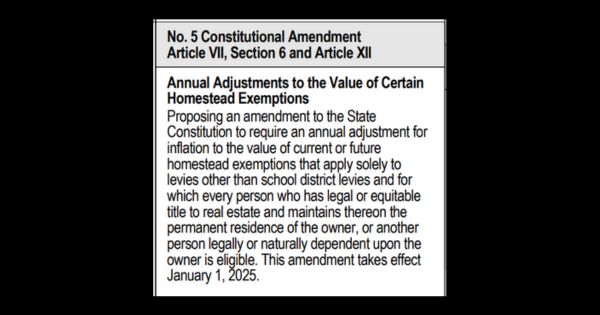

The ballot summary reads, “Proposing an amendment to the State Constitution to require an annual adjustment for inflation to the value of current or future homestead exemptions that apply solely to levies other than school district levies and for which every person who has legal or equitable title to real estate and maintains thereon the permanent residence of the owner, or another person legally or naturally dependent upon the owner is eligible.”

In simple terms, homeowners in Florida could exempt a portion of the value of their primary residence from property taxes. Florida Amendment 5 would create an annual adjustment of that exemption according to the Consumer Price Index if the change is positive that year. The homestead exemption does not apply to property taxes that go to schools.

Proponents of Amendment 5

Local Republican clubs and Florida Tax Watch support the amendment and point out that in the past voters have supported measures dealing with lowering property taxes,

The sponsors of the amendment Florida State Reps. Alina Garcia and James Buchanan championed the proposal , claiming that with the high cost of inflation and higher housing prices, the amendment could help ease homeowners’ pain, especially seniors and those on fixed incomes.

Opponents of Amendment 5

In addition to most local newspapers, groups like the Florida League of Cities and Democratic legislators say that Amendment 5 will lead to higher taxes on non-homeowners and limit future property tax revenues in the millions for local governments in Florida.

Over the years, The Florida League of Cities argued that when Tallahassee lawmakers push for statewide property tax exemptions, they hurt local government. The league points out that local property tax (millage) rates are set by cities, counties, school districts and special districts.

Opponents also say that while Amendment 5 may lower taxes on some people, it will raise them on others, like individuals who rent and those who own businesses, because the cities will have to make up for that loss of revenue.

“Tax cuts are almost always a good thing. But, since Amendment 5 would only apply to homeowners and not to other property owners, including commercial properties and rental properties (and therefore renters), it’s not the most effective or fair way to cut taxes,” said Adrian Moore, VP of policy at the Reason Foundation.

Moore says the argument that Amendment 5 would reduce local government revenues is not true.

“Amendment 5 only adjusts the homestead exemption for inflation, so it reduces the future rate of increase in revenue for local governments but does not reduce their revenues,” said Moore.