The conservative Libertarian think tank CATO Institute, released its Report Card covering the governors in all 50 states.It examines issues from the state budgets, including tax and spending policies and the expansion of school choice programs.

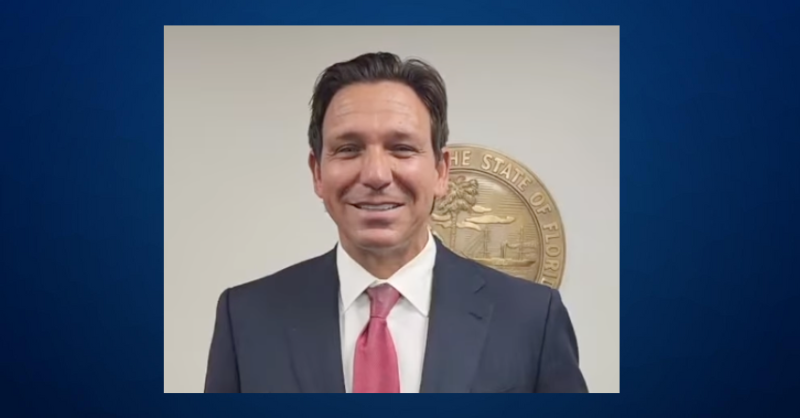

Looking at Florida from 2022-2024, CATO gave Florida Governor Ron DeSantis a C grade. It praised Florida for being the second-freest state according to Cato’s ranking and having a low-tax state with no individual income tax. It also credited DeSantis approved a temporary reduction in the corporate tax rate and a bill to avoid business tax increases related to the federal Tax Cuts and Jobs Act.

“DeSantis has frequently signed legislation providing temporary tax breaks, including annual sales tax holidays, rebates, a suspension of the gas tax, and similar sorts of breaks,” an excerpt in the report read. “Using budget surpluses for temporary tax breaks has reduced funds available for spending,”

However, CATO said it would have been better if the governor and the state legislature had made these tax reforms permanent. In 2023, DeSantis signed some permanent reforms regarding the tax on commercial leases. The governor signed legislation reducing it from 5.5 percent to 4.5 percent and then to 2 percent in 2024. This measure will save Florida businesses more than $1 billion a year.

On spending, CATO says DeSantis scores were above average. “He has proposed lean budgets, although the legislature has usually passed higher spending. He does not shy away from vetoing spending (as) DeSantis vetoed $1 billion from the 2025 budget,” said the group.

The metrics used by the CATO Institute came from National Association of State Budget Officers (NASBO), the National Conference of State Legislatures, the Tax Foundation, the budget agencies of each state, and news articles. The data cover the period from January 2022 to August 2024.

Six governors receive a grade of A: Kim Reynolds of Iowa, Jim Pillen of Nebraska, Jim Justice of West Virginia, Sarah Huckabee Sanders of Arkansas, Kristi Noem of South Dakota, and Greg Gianforte of Montana.