Florida has bragging rights about having no income tax or inheritance or estate tax. However, compared to the other 50 states, Florida is about in the middle when it comes to state sales tax.

The Tax Foundation ranks Florida as the 24th highest sales tax rate. But if you include local county and city sales tax rates, it even goes higher.

Currently, Florida’s sales tax is 6%, but many other counties have raised their local sales tax by a full point and even more.

A close look at the numbers reveals that most counties have a tax rate of 7% and several more at 7.5%

A total of 38 states, including Florida, let county governments raise the sales tax. The only county in Florida with a local sales tax below the average 7% is Citrus County.

Florida’s combined sales tax is lower than several southern states. The Louisiana combined sales tax was just over 9.5%, followed by Tennessee at 9.5% and Alabama at 9.30%.

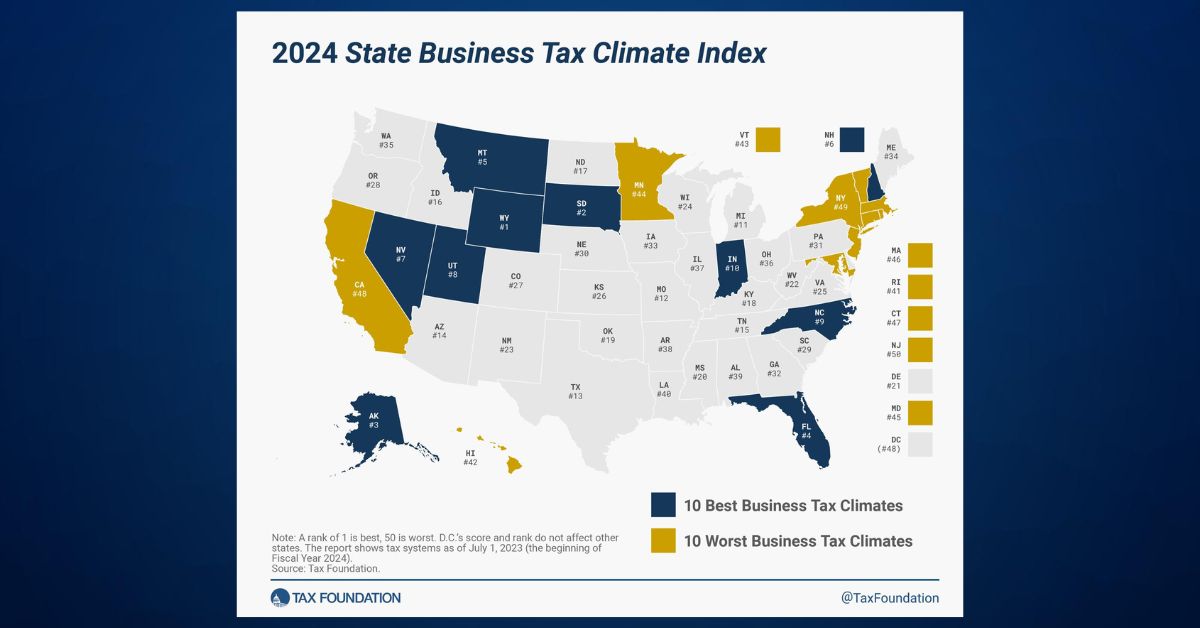

Alaska was ranked number, followed by Delaware, Montana, New Hampshire and Oregon, all 5 don’t have a state sales tax.

When you combine Florida’s state sales rate with local numbers, together the amount to an average of 7.5%, but it doesn’t take in account of other local taxes that are collected.

Many counties have a tourist tax and a bed tax, and depending on city, county, and local tax jurisdictions, the total rate can be as high as 8-10%, which is collected locally, not including the property tax.

The Florida Department of Revenue says its state sales tax generated around $35.8 billion of the state’s $47.33 billion in total collections, or 75.6%.

The argument of having a sales tax versus an income tax is also in Florida’s favor. In past recessions, other states have had to raise their property taxes to keep the government going, but Florida has been able to do that without raising the sales. The last time the states sales tax went up was in 1988, it increased from 5 to 6%.