On Thursday, Gov. Ron DeSantis announced that the first Small Business Emergency Bridge Loan has been approved for a business impacted by Hurricane Sally which impacted the state last month.

The Florida Department of Economic Opportunity (DEO) will provide the loan to Brett Hinely, owner of Bluewater Bay Marina in Niceville, Florida. The loan was approved in a short, four business day review process after the loan program was activated on Wednesday, September 23, 2020.

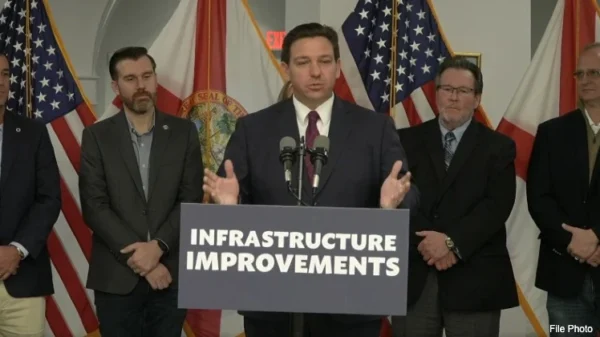

“Supporting businesses and helping employees get back to work is an important step toward helping Florida families, businesses and communities recover from the impacts of Hurricane Sally,” said DeSantis. “I am pleased to provide these loans to impacted businesses as quickly as possible.”

The Department administers the Florida Small Business Emergency Bridge Loan Program in partnership with the Florida SBDC Network and Florida First Capital Finance Corporation to provide cash flow to businesses economically impacted by Hurricane Sally. The short-term, interest-free loans help bridge the gap between the time the economic impact occurred and when a business secures other financing, including Small Business Administration (SBA) loans or commercially available loans, payment of insurance claims or other available resources.

“Governor DeSantis’ leadership and focus on supporting businesses and communities impacted by Hurricane Sally has been essential to helping Northwest Florida return to normal,” said Florida Department of Economic Opportunity Executive Director Dane Eagle. “We appreciate our partners at the Florida SBDC Network and Florida First Capital Finance Corporation, who have helped us review and approve these loans quickly to ensure those businesses are able to access this critical funding. Our team will continue to do all we can to help small businesses and families recover.”

Up to $5 million has been allocated for the Small Business Emergency Bridge Loan program. Small business owners with two to 100 employees located in Escambia, Okaloosa and Santa Rosa counties affected by Hurricane Sally can apply for short-term loans up to $50,000. To be eligible, a business must have been established prior to September 14, 2020, and demonstrate economic injury or physical damage as a result of Hurricane Sally. The application period is open until November 14, 2020, or until all available funds are expended. Businesses can apply at www.FloridaJobs.org/EBL.

The Department continues to encourage businesses in Northwest Florida that have been impacted by Hurricane Sally to complete the Business Damage Assessment survey at FloridaDisaster.biz. Select “Hurricane Sally” from the drop-down menu on the survey page. Response to the Business Damage Assessment survey is not an application for assistance. Businesses interested in the bridge loan program must fill out a bridge loan application.