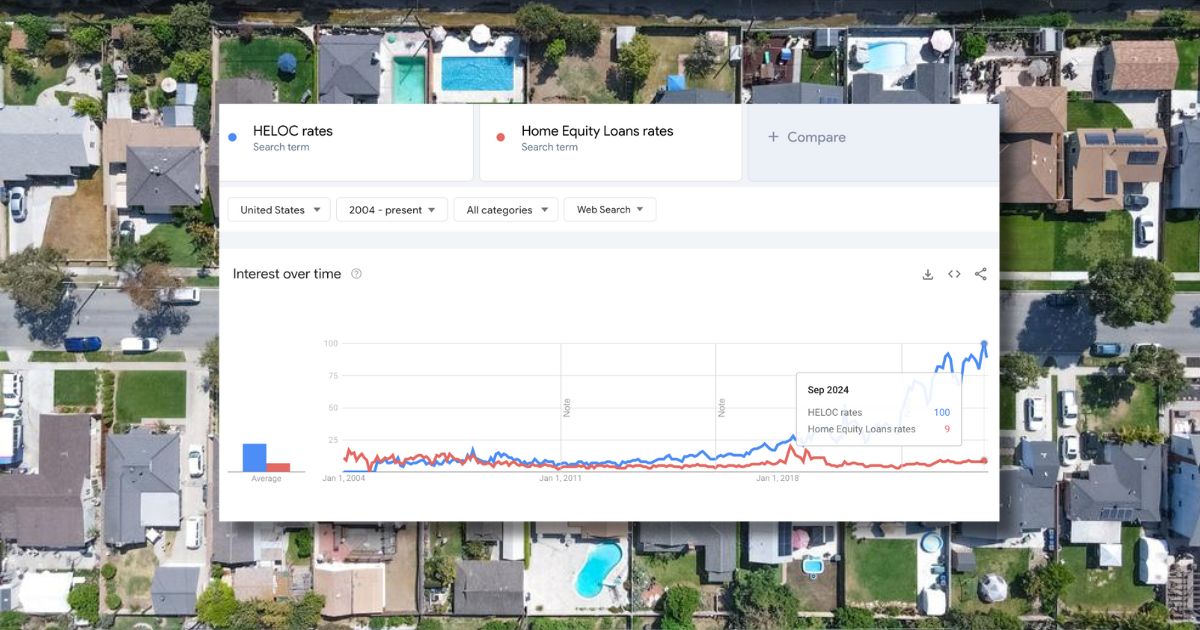

Interest in Home Equity Lone of Credit (HELOC) loan rates appears to be at a record-high in America. A recent report from Mortgage broker experts Eden Emerald Mortgages revealed that US searches for “HELOC rates” have spiked, while searches for “Home Equity Loans rates” remain unchanged.

“HELOC rates” is Americans second top refinance-related search term, an average 155,935 searches per month.

“The Mortgage Bankers Association reported another increase in its weekly refi index recently, as refinancing continues to gain traction slowly,” said Shaun Bettman, CEO of Eden Emerald Mortgages. “The average 30-year fixed-mortgage rate has dropped from this year’s high of 7.52% in April to 6.25% as of September 25, and some borrowers who secured 7.0% to 8.0% rates over the past 24 months are taking advantage of the recent rate dip for relief.

Mortgage broker experts Eden Emerald Mortgages, also recently analyzed all 50 states based on the number of times each state searches for terms related to remortgaging.

Using Google Keyword Planner, the search terms “refinance” and “lender” were combined with 41 templates. Templates include “free [refinance] advice,” “how much does it cost to [refinance],” “[refinance] deals,” “how long does it take to [refinance],” and “[refinance] to release equity.”

A total of 961 search combinations were analyzed, including “lending calculator,” “HELOC rates,” “HELOC,” “home equity line of credit,” “HELOC calculator,” “chase remortgage,” “lending broker,” “refinance calculator,” and “SoFi lending.”

A list of the 16 best mortgage and refinance lenders of August 2024 were analyzed, including “Chase,” “SoFi,” “Ally,” “Bank of America,” “PNC,” “Rocket,” and “Mr. Cooper.”

The total number of search terms for each state was then compared to the population to calculate the number of searches per 100,000 people.