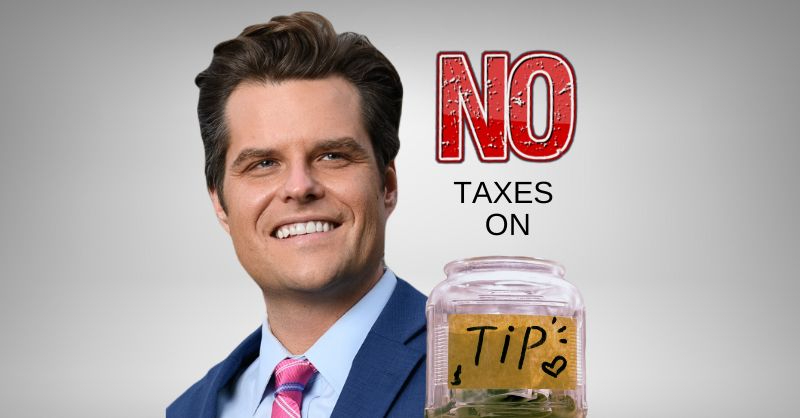

Florida Congressman Matt Gaetz (R) and his Republican colleague Thomas Massie (KY) introduced the Tax Free Tips Act of 2024.

“As the cost of living continues to rise, the hardworking men and women in the service industry, many of whom may be working a second job to make ends meet, must be allowed to keep every dollar of tip money they earn,” Gaetz said. “I am proud to join with Rep. Thomas Massie in co-leading this important tax-relief legislation.”

The bill aims to provide financial relief to service-industry workers by eliminating federal income and employment taxes on their tips. It follows President Donald Trump’s recent announcement that eliminating the tax on tips is one of his top legislative priorities for a potential second term. Rep. Marjorie Taylor Greene (GA-14) is an original co-sponsor.

“Ron Paul had it right and so does Donald Trump,” said Rep. Thomas Massie (R-KY). “Taxing tips is regressive and goes against American tradition. But now digital payments allow the government to tax every transaction, even those that historically have not been taxed. With inflation raging, it only makes sense to eliminate the tax on tips and provide relief to working folks.”

Full text of Congressmen Gaetz and Massie’s legislation can be found HERE.